NASDAQ: RENX

Environmental Solutions & Sustainable Infrastructure Platform

Rooted in Vision. Moving with Purpose.

Company Overview

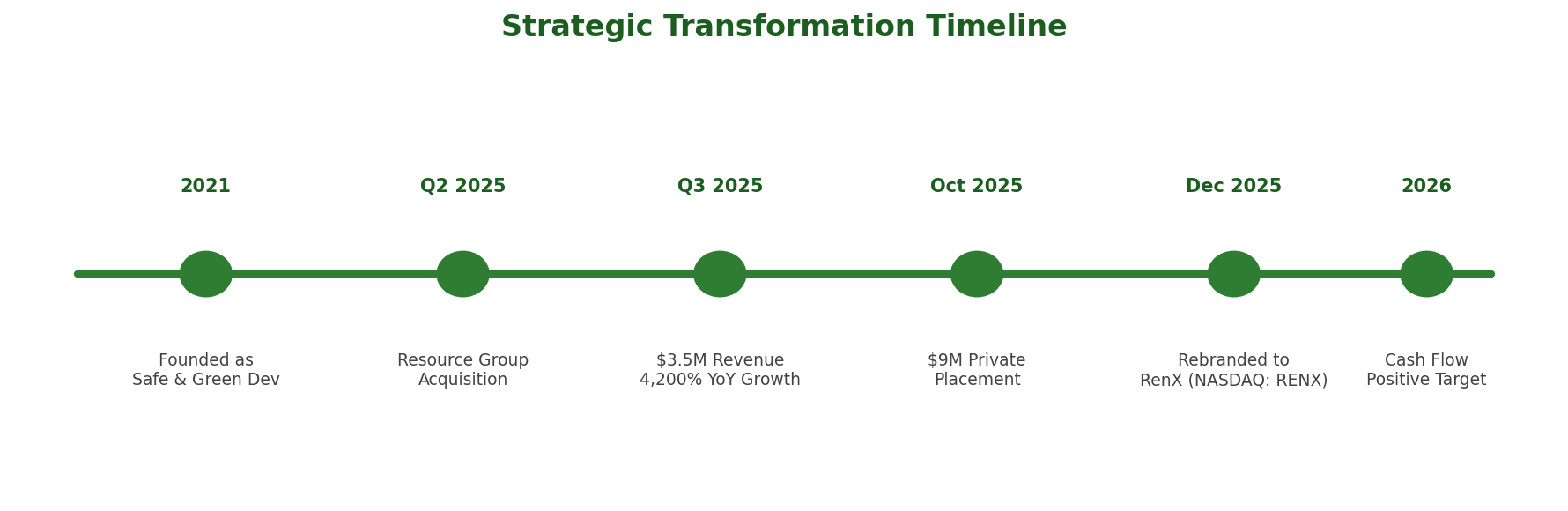

RenX Enterprises Corp. (NASDAQ: RENX), formerly Safe and Green Development Corporation, is a real estate development and environmental solutions company headquartered in Miami, Florida. The Company has undergone a transformational strategic pivot, shifting its primary business focus from traditional real estate development to providing cutting-edge environmental solutions.

Through the strategic acquisition of Resource Group in fiscal 2025, RenX has established a vertically integrated platform encompassing environmental processing, logistics services, and the production of sustainable, high-margin engineered soil products and growing media.

|

2025 Revenue |

Capital Raised |

Facility Size |

YoY Growth |

|

~$7 Million |

$9 Million |

80+ Acres |

1,300%+ |

Financial Performance

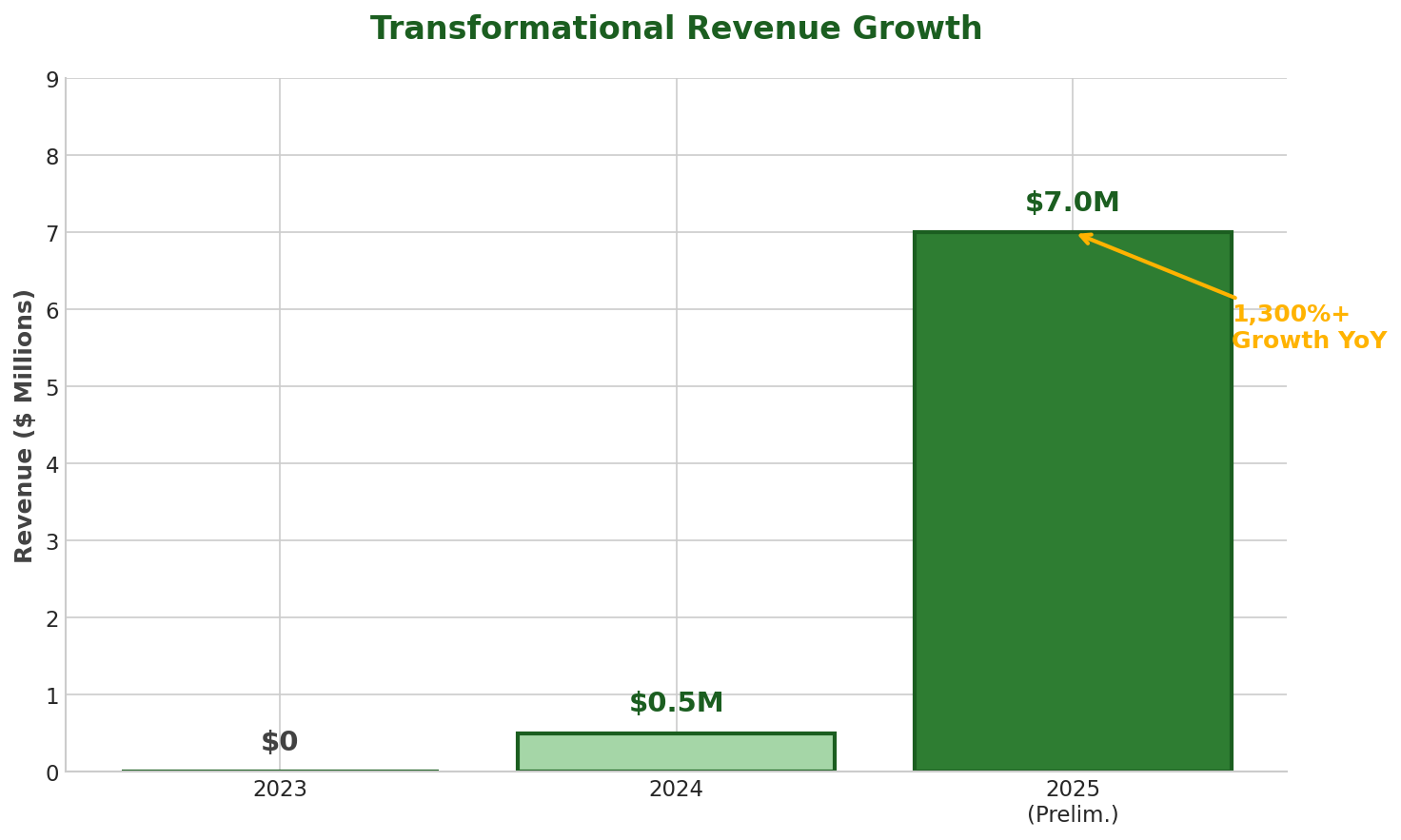

RenX delivered transformational financial results in 2025, generating approximately $7 million in gross revenues compared to less than $500,000 in 2024. This extraordinary growth trajectory reflects the successful integration of Resource Group and the strategic pivot to environmental solutions.

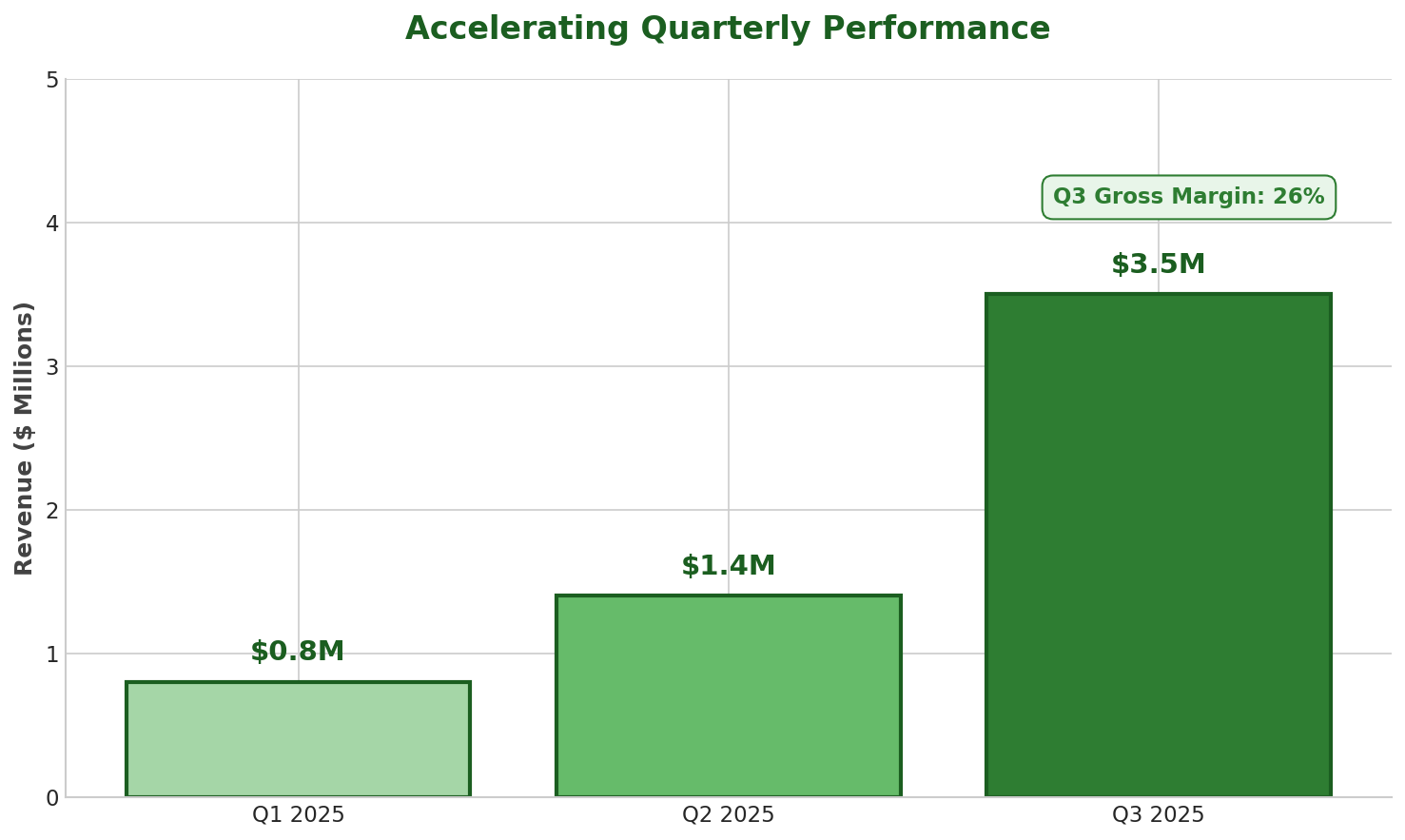

Q3 2025 represented a record quarter with $3.5 million in revenue and a 26% gross margin, demonstrating accelerating operational leverage as the platform scales. The Company achieved 4,200% year-over-year revenue growth in Q3, validating the strategic transformation.

Diversified Business Model

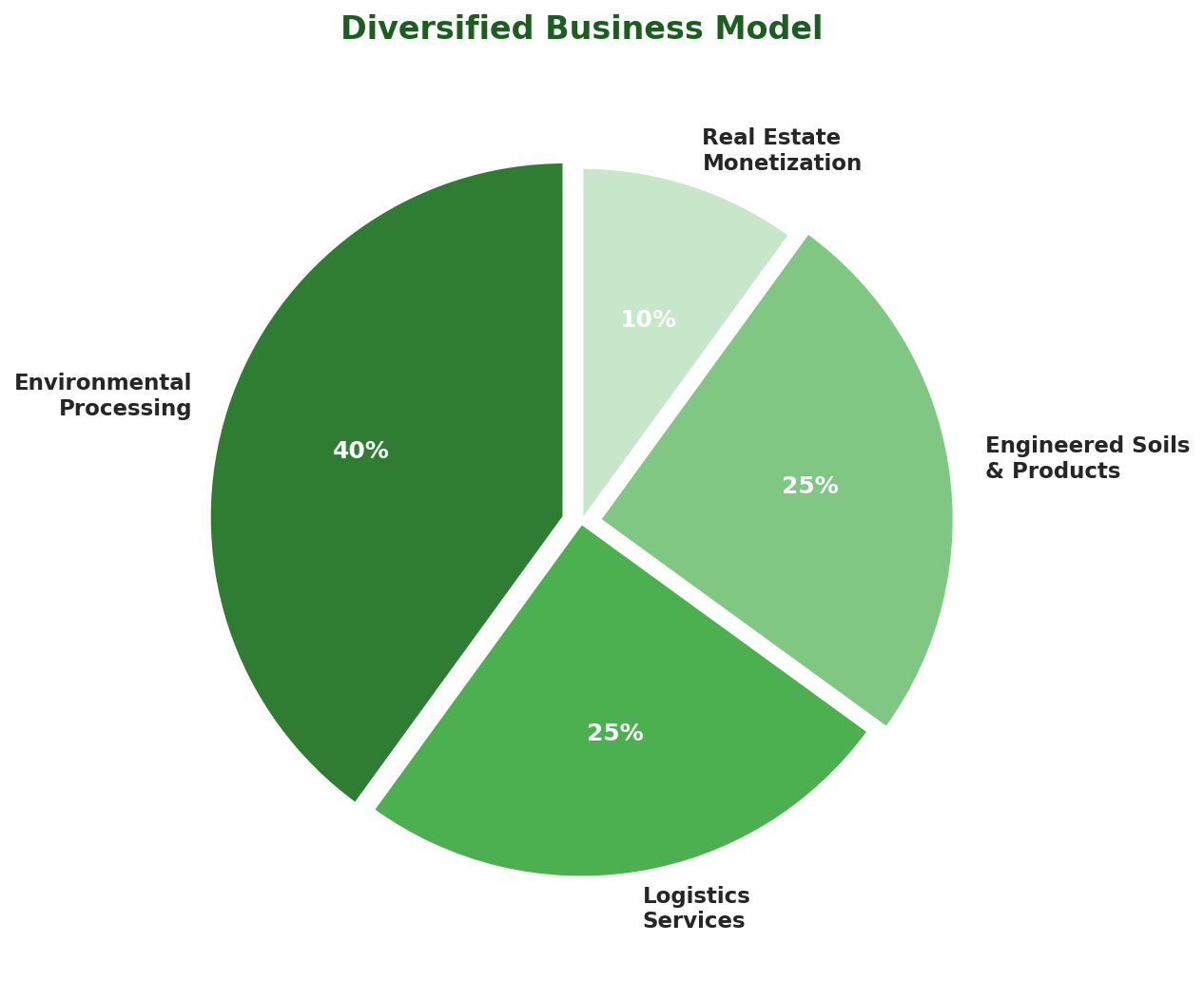

RenX operates through a vertically integrated platform designed to scale high-margin soil products, sustainable substrates, and regenerative land-use solutions across three primary verticals:

|

Environmental Processing |

80+ acre permitted organics processing facility in Myakka City, FL. Processes source-separated green waste into value-added products. |

|

Logistics Services |

Transportation services across biomass, solid waste, and recyclable materials supporting both internal operations and third-party infrastructure. |

|

Engineered Soils & Products |

High-margin potting media, soil substrates, mulch, and compost. Exclusive US license for Microtec technology enables scalable production. |

|

Real Estate Monetization |

Legacy portfolio monetization including property sales and debt restructuring (Lago Vista property transferred at $5.0M conditional valuation). |

Strategic Assets & Equipment

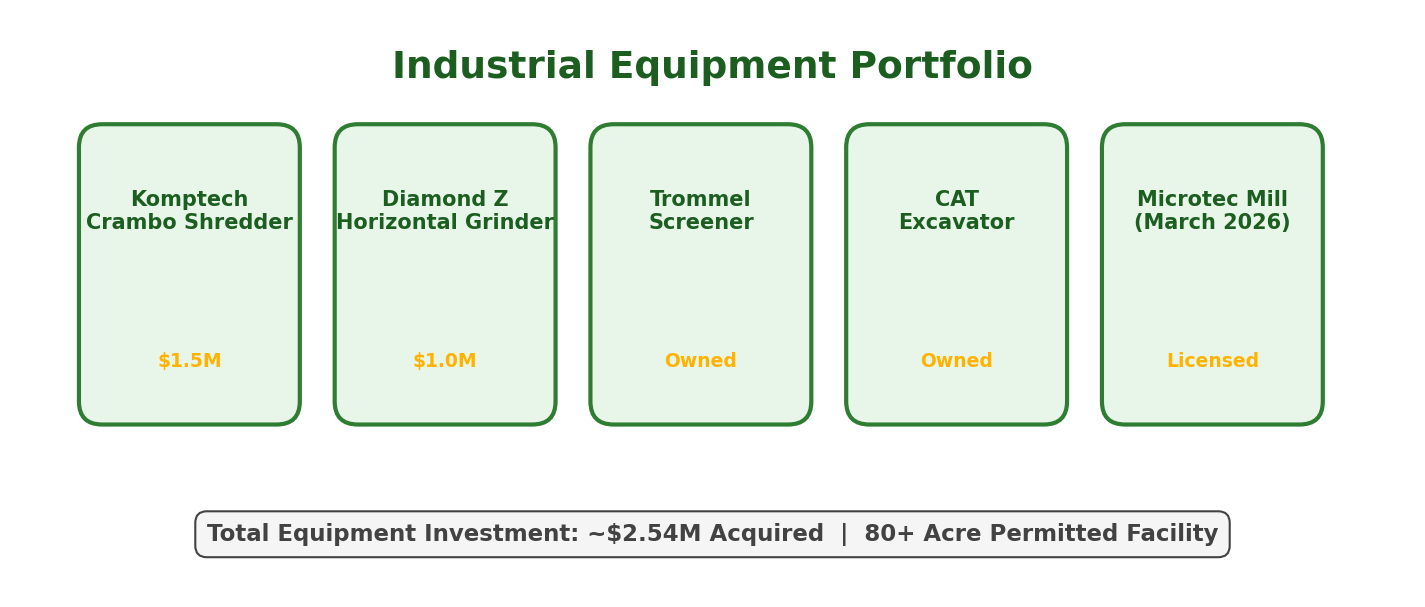

RenX has invested in a robust portfolio of industrial processing equipment to support its environmental solutions platform. These investments enhance throughput, processing efficiency, and revenue generation capacity.

The acquisition of the Komptech Crambo shredder and Diamond Z horizontal grinder for $2.54 million followed a successful rental trial demonstrating increased throughput and improved processing efficiency. The patented Microtec Mill, expected March 2026, will enable advanced milling and materials-engineering capabilities under an exclusive US license.

|

Microtec Technology Partnership RenX maintains an exclusive US license from Microtec Development & Holdings (backed by Ara Partners) for biomass applications. The technology enables production of sustainable growing media from locally sourced organic waste as a domestic alternative to peat and imported substrates. |

Strategic Timeline & Growth Roadmap

Looking forward, RenX is executing on a clear growth strategy focused on expanding higher-value products and achieving cash flow positivity by mid-2026. Key initiatives include:

|

Q1-Q2 2026 |

Microtec Mill deployment; expansion into bagged materials and engineered soils |

|

Mid-2026 |

Targeted cash flow positivity; scaled production of sustainable growing media |

|

2026+ |

Multi-facility expansion; regional product formulations; continued real estate monetization |

Leadership

|

David Villarreal Chief Executive Officer |

Leading the strategic transformation from real estate development to environmental solutions, with focus on execution, expanding higher-value products, and unlocking value for shareholders. |

|

Nicolai Brune Chief Financial Officer |

Overseeing financial strategy including debt restructuring, capital raises, and balance sheet optimization to support growth initiatives. |

|

Bob Jacobson Strategic Business Advisor |

Over 50 years of retail garden experience including 20+ years at Home Depot supporting growth and leading national category strategy for multi-billion-dollar product categories. |

|

Investor Relations 1111 Brickell Avenue, Floor 11, Suite 109, Miami, Florida 33131 Website: www.renxent.com | IR: ir.renxent.com Phone: (786) 808-5776 | Email: info@sgdevco.com |

Forward-Looking Statements: This document contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These statements involve known and unknown risks, uncertainties and other factors which may cause actual results to differ materially from those expressed or implied. Investors should conduct their own due diligence and consult with financial advisors before making investment decisions.

DISCLAIMER

Vanderbiltreport.com are owned and operated by AB Holding a US-based corporation. We have received compensation of up to $100,000 regarding the profiling of RenX Enterprises Corp. (NASDAQ: RENX) starting on Feb 1, 2026. It is important to note that we do not own any shares in RENX: NASDAQ.